State-run pension scheme, the National Social Security Fund (NSSF), has declared an 11.23% interest rate on members’ savings for the financial year 2016/2017 against high inflation which stands at 8.68 %.

The fund on Friday declared it’s financial performance report, as size grew by 20% from shs6.6 trillion in 2016 to shs7.924 trillion in 2017 with compliance levels growing to 80% from 78% in 2016 while contributions grew by 15% to shs917 billion from shs785 billion in 2016.

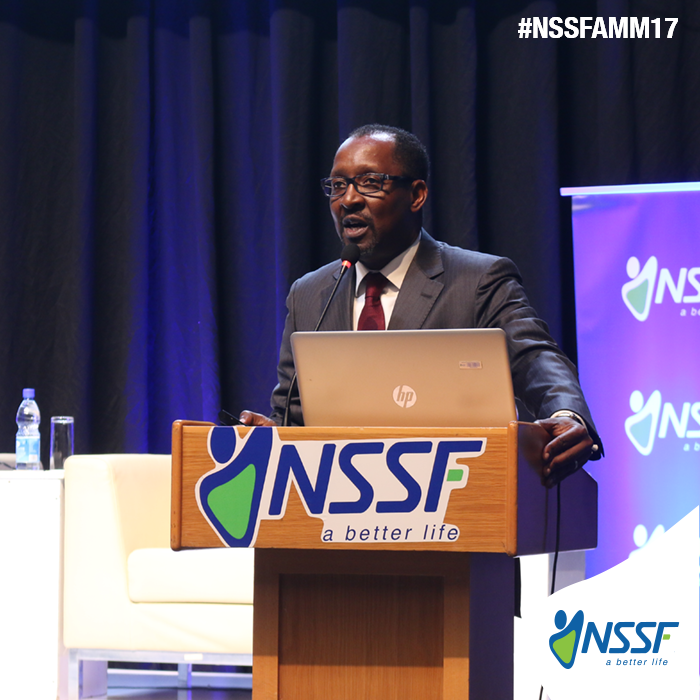

Speaking at the 5th Annual Members Meeting at the Kampala Serena Hotel, Richard Byarugaba, the NSSF Managing Director, attributed the fund’s good performance to its aggressive investment and marketing strategy and improved compliance levels from members.

“Although there has been a reduction in interest paid from 12.3% in 2016 to 11.23% in 2017, this is still 2.6% above the 10-year average inflation rate of 8.68%, which is well within the Fund’s strategic target of paying interest rate, that is 2% above the 10-year average inflation rate.” Said Byarugaba affirming that NSSF continues to deliver year on year profit and returns on member’s savings, owing largely to calculated investment decisions the fund makes.

With an income of 912 billion on UGX7.924 trillion, NSSF’s Return on Assets (11.51%) is above the industry average of 8%, according to the URBRA Retirement Benefits Sector Report for 2016. According to the report, the sector posted 8% return on assets in 2016 compared to 14% in 2015, a commendable performance given the environment of declining interest rate and depressed equity market conditions, witnessed in 2016.”

The consistent good performance and accountability by the current management of fund have led to increased positive reputation for NSSF which has inadvertently led to an increase in public trust.

“We have invested a lot in campaigns and activities that continue to enhance the good image of NSSF. Because of this, our members and the public have a renewed appreciation for the purpose of the fund, and we have seen this confidence reflected in the improved compliance levels of existing corporate members and the quick uptake of our newly launched voluntary saving scheme.” Said Byaruhanga who also added that there has been a 246% increase (three and a half times) in interest paid from UGX197 billion in 2017 to UGX681 billion in 2017. Compared to last year, there has been a 12% increment from UGX606 billion to UGX681 billion.”

“The fact that more and more workers are entrusting their money with us annually shows that we have earned their trust. It is therefore our obligation to continuously improve our processes through automation and provide our members with a great customer experience. We will also continue to seek more competitive investment opportunities both in and outside the country to strengthen our financial performance and ensure adequate and satisfactory returns to our members,” Byarugaba noted.

The fund’s investment portfolio is in three major areas; of Fixed Income, Equity and Real Estate. Real estate investments include, the Ushs15.5 billion Mbuya housing project, the Ushs3.3 billion Jinja commercial complex, the upcoming Mbarara commercial complex, Workers House, Social Security House, Pension Towers and the recently commission $400 million Lubowa Housing Estate.

On future investments, Byarugaba noted that the Ugandan economy is projected to rebound on the back of increased investment and productivity in key sectors of Agriculture, Tourism and Minerals, Oil and Gas, as well as the informal sector and the Fund is well positioned to take advantage of these growth opportunities.

The Annual Members Meeting The meeting was graced by Evelyn Anite, State Minister of Finance for Investment & Privatization representing the Hon. Minister of Finance, Planning & Economic, members of the fund, NSSF staff and the press. The most compliant employers in remitting their employees’ contributions were recognized and awarded at this event.