Since introduction of mobile money in Uganda by Bank of Uganda (BoU) in 2009, there has been financial inclusion with millions of people acquiring mobile money accounts.

Today, transactions this year hit Shs44 trillion and like in the neighbouring Kenya, mobile money is playing a key role in Uganda’s economy in terms of financial inclusion and quick payments for goods and services since many people are beginning to prefer using it to traditional banking means of payments.

By November, Ugandans will be able to send money to each other domestically without paying transaction fees via newer mVisa with the likes of MTN, Airtel, Uganda Telecom, Africell, M-cash, PayWay and Eeezy Money facing their biggest competition ever.

Last week, global payments giant Visa announced its support of the new global QR Code Payment Specifications from EMVCo, the global technical body that manages the EMV Specifications. The specifications cover consumer-presented and merchant-presented QR code use cases for digital payment acceptance. QR Codes are two-dimensional machine-readable barcodes, used to facilitate mobile payments at the point-of-sale.

Growth in mobile money has surpassed that of the traditional banks in terms account holders and TheUgandan understands that E‑money represents a promising opportunity to provide low-income individuals with more than just payment and safe storage services, and it is increasingly becoming a savings vehicle.

Visa and the other EMVCo Members worked to develop these new globally interoperable EMV specifications. Visa has already successfully enabled the merchant-presented QR technology in 15 countries around the world.

“We’ve already seen tremendous progress towards adoption of standardized, interoperable QR code payment systems in the developing world,” said Sam Shrauger, SVP, Digital Products, Visa. “We are working with governments and central banks in countries like India to develop and implement QR code payment solutions that provide the convenience and security that are synonymous with Visa and help the journey toward a cashless future.”

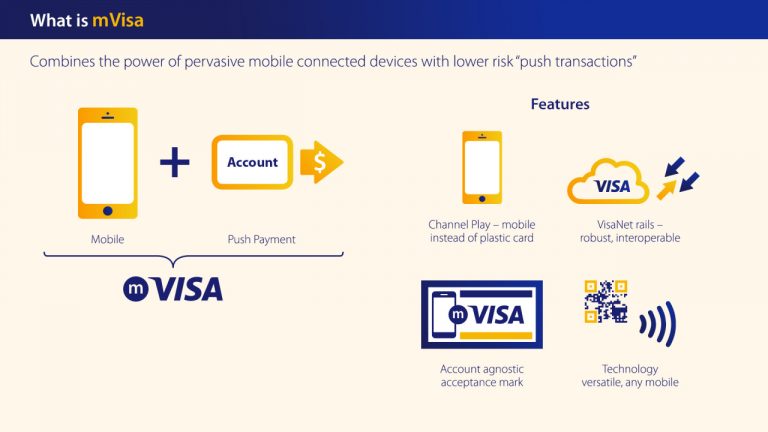

Visa has enabled the growth of merchant-presented QR code payments around the world with its innovative mobile payments solution, mVisa. mVisa allows consumers to pay for goods and services by scanning a QR code on a smart phone or entering a merchant number into their feature phones. Payment goes straight from the consumer’s Visa account into the merchant’s account and provides real-time notification to both parties. mVisa is completely interoperable, meaning that the consumer and the merchant do not need to be customers of the same bank. This brings the same convenience, security and reliability provided by the trusted Visa brand.

For merchants eager to harness of the power of QR code payments, the Visa Ready Program has adopted the interoperable QR standards to develop tools and capabilities which help easy generation and deployment of QR code merchants by banks, processors and merchant aggregators. Once enrolled, merchants can freely accept payments from any country or bank given mVisa’s interoperability while trusting Visa will securely and efficiently process each transaction.

As digital payments help continue a shift toward a cashless future, this new global specification is an important step that promotes interoperability and standardizes the fast growing ecosystem of QR code payments across the world. Already, 33 banks and more than 328,000 merchants across India, Kenya and Nigeria have adopted the interoperable standards as they accelerate their QR code digital payment programs.

“mVisa enables successful completion of the transaction independent of the mobile operator service on both the consumer and the merchants phone, and the consumers and merchant’s banks” said Shrauger. “This addresses a major challenge with mobile money programs, and lets consumers and merchants choose their own bank or mobile operator.”

Banks have recently been encouraging the adoption of standardized QR code payments to provide access to low-cost, secure digital payments to millions of consumers and merchants. Working with our partners, Visa is converting both every day and recurring cash purchases to digital payments through direct integrations with supermarket chains and large utility billers.

Visa intends to replicate this success in 12 other countries where mVisa has been enabled: Cambodia, Egypt, Ghana, Indonesia, Kazakhstan, Malaysia, Pakistan, Rwanda, Tanzania, Thailand, Uganda and Vietnam.