Uganda started the journey from a cash-dominated economy to a digital-based economy in 2009. The country is emerging as a strong performer in digital financial services (DFS).

Financial inclusion insights Uganda (2016) shows that close to 4 in every 10 Ugandan adults (39%) now have access to financial services. 35% have a mobile money account, 11% have a full-service bank account, while 6% have an account in a non-banking financial institution.

According to World Bank’s Global Findex data, 35% of Uganda’s adult population, or 6.7 million people, have mobile money accounts. Instead of paying with cash, cheque, or credit cards, a consumer can use a mobile phone to pay for a wide range of services and digital or hard goods that range from buying airtime top-ups to paying salaries, utility bills and school fees.

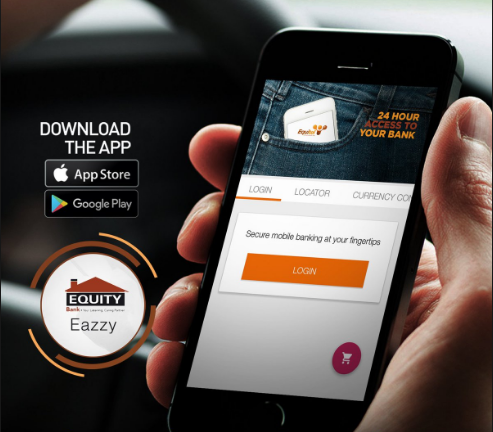

Today, trillions of Shillings are being transacted across the country using mobile-based payments, Bank of Uganda figures collaborate. Now, Equity Bank’s recently launched Eazzy Banking App platform, will further simplify people’s life regarding access to financial services.

TheUgandan understands that after Eazzy Banking application’s success in the Kenyan market over the past year, performing over 350,000 daily transactions and transactions values of over Kshs 6.5 Billion per month, the Bank’s Managing Director in Uganda, Mr. Samuel Kirubi also launched the product in Kampala last Friday.

The platform will offer real time access to your account status, transfer of funds to other Equity Bank accounts or mobile wallets, payment of utility bills like Umeme and water bills, purchase of airtime and so much more.

“From sending money to paying for goods and services, accessing EazzyLoans, paying bills, checking the status of your account or saving for your future goals, it is all in your hands with there being no need to physically visit the bank,” Samuel Kirubi, the Equity Bank Managing Director said, during the launch.

“With the EazzyBanking App in hand, which you can download from Google Play Store or the Apple Store, we shall enable Ugandans to bank anywhere, anytime,” he added.

Through the EazzyBanking App, loans will be provided by Equity Bank Uganda Ltd. The EazzyLoan application requires at least 6 months of active account use for a user to qualify to access credit, a requirement most of the mobile lending apps do not have. You do not need a minimum operating balance in your account either at the time of applying for the loan.

The EazzyBanking App got a major upgrade in September this year enabling it have enhanced features and functionalities. This has made the App one of the highest rated banking Apps in the world.

For feedback and story tips, contact: stephenmuneza@gmail.com, +256772544870 (Whatsapp) 0705367895 (calls) or Twitter @stephenkmuneza