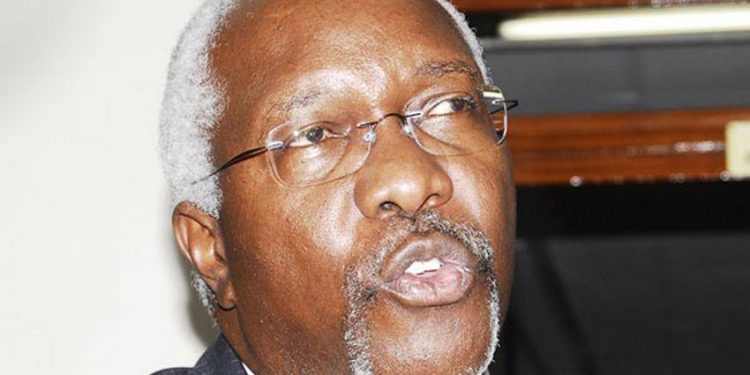

The Auditor General, John Muwanga has raised concerns over the absence of tax exemptions in Uganda saying the failure to establish mechanisms on how tax exemptions and incentives are awarded exposes the system to abuse.

Muwanga’s warnings are contained in the 2020 Auditor General’s report to Parliament where he observed that there are no clear policy guidelines for the issuance, management and monitoring of the different tax benefits and incentives issued by the Government to different individuals.

The Auditor General cited a scenario that saw Government grant a waiver of import duty for steel goods while offering 10 year tax holiday to the steel sector with the aim of promoting growth of the sector as well as boosting employment.

Civil Society activists- Southern and Eastern Africa Trade, Information and Negotiations Institute (SEATINI)–Uganda welcomed the observation in the Auditor General’s report saying it resonates with what CSOs under the Tax Justice Alliance have been highlighting in our advocacy on; the need to widen the tax base in a fair, equitable and accountable way.

Regina Navuga, Programme Officer, Financing for Development Programme said that instead of deepening the tax burden, taxing the same people over time, government needs to step up its efforts to broaden the tax base which in the long run will increase the revenue hence the tax to GDP ratio.

She added that although domestic revenue is the most reliable source of funding for sustainable for sustainable development, there are a number of challenges including tax evasion and avoidance by individuals and companies which needs to be addressed.”

She also argued that although Government is developing the tax expenditure governance framework to address this issue; there is need to fast track the policy and ensure that it is followed to the latter.

The Auditor General’s report comes at the time when Parliament in May 2019 voted in support of a proposal from Ministry of Finance to write off taxes to a tune of Shs500Bn from private companies.

This proposal was first brought before Parliament in 2016 when the Ministry of Finance tabled a supplementary request, seeking for Shs47.705Bn to offset tax arrears for some companies.

Among the companies that benefitted from the tax bonanza include; Roko Construction Limited Shs5.849Bn, Cementer Limited Shs4.618Bn, Dott Services Limited Shs8.321Bn, Steel and Tubes Industries Ltd income tax following tax holiday amounting to Shs20.486Bn, Cipla Quality Chemical Industries Limited for the manufacture of antiretroviral therapy drugs as income tax holiday amounting to Shs57.515Bn.

The others were; Guangzhou Dongsong Energy Group for the Sukulu phosphates project in Stamp duty amounting to Shs8.460Bn and Oil Palm Uganda Limited both income tax and VAT tax holiday Shs175.802Bn, Bugisu Cooperative Union Shs3Bn in Aya Investment Uganda Shs3.941Bn among others.

Navuga while reacting to the Auditor General’s findings said that there should not be giving blanket tax incentives, or incentives for more than 5 five years to give Uganda a chance to review and assess whether the objectives have been met. If not convincing, reinstate the taxes.

She also pointed out that the Auditor General’s report highlights the increased indebtedness arguing that if Government cannot raise adequate funds to finance socio-economic development, then the quick way out will be to borrow both internally and externally.

Other experts commended the Auditor General for making the bold move to warn Government about absence of the policy saying the failure is likely to be exploited within the country and blamed the trend on absence of proper governance and urged law makers to get themselves involved in scrutunising the validity of tax exemptions.