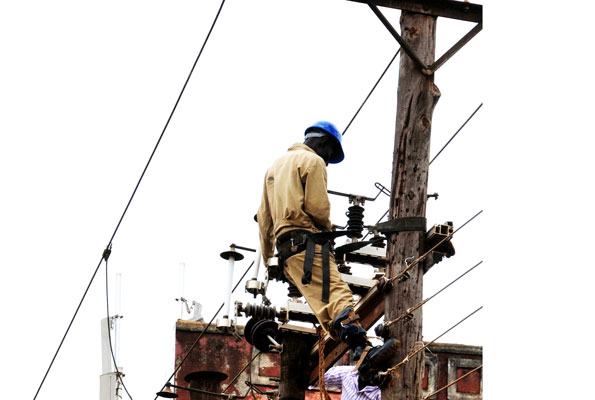

A power technician works on a faulty line in Kampala. (File Photo)

National power distributor Umeme Ltd has shown again how it is not just a banter company but rather an attractive investment and announced sale of its shares by amounting to 14.3% in a multibillion deal.

Umeme in keeping with their obligations under the Uganda Securities Exchange (USE) Listing Rules, informed the USE of the intended sale over the weekend. Trading in the shares has since been suspended for a period of one week, from 7th – 15th November 2016.

To the uproar that followed the announcement that the power firm was voluntarily suspending trading in 2014 during their heavily oversubscribed 18.5% or $40m sale offer to Investec Asset Management, Stephen Ilungole, Umeme Media Relations Manager said all was well this time.

“We would like to reassure our customers, employees, shareholders and the general public that the proposed transaction will not impact in any way on the operations of Umeme or its commitments under its respective licenses and agreements,” Mr. Illungole told this news website.

TheUgandan understands that National Social Security Fund (NSSF) is the buyer who has reached an agreement to buy 121,820,850 shares of Actis Infrastructure through its Ugandan subsidiary, Umeme Holdings Limited at a price of Ushs 488 per share.

“This is an additional investment of about Ushs 59.4 billion in Umeme Limited. It effectively increases the Fund`s total stake in the company from 15.5 percent (251,951,071 shares) to 23 percent (373,771,921 shares),” NSSF boss Richard Byarugaba said on Monday.

This puts to rest rumours that President Museveni had ordered Umeme to sell a significant stake of its shares to a wealthy Middle East-based Fund known as Egypt Kuwait Holding Company (EKHC).

Umeme made its debut on the Uganda Securities Exchange (USE) on in November 2012. The firm’s Initial Public Offer (IPO) was a success, and it picked up several nods, including being voted the best IPO in Africa in 2012 in the Europe, Middle East and Africa (EMEA) Finance awards.

The retail piece was launched on the USE on Monday May 19, 2014 and was Ush12b ($5m), an additional $7m was allocated to Management and Directors of Umeme.

On that day 705,800 shares were traded on the special lots board at Ush340 each to register a turnover of Ush239.97 million. The counter had an outstanding demand of 33.43 million shares by the close of the day’s trading session.

The power firm has a 25-year power distribution concession in Uganda although there have been recent concerns from stakeholders who accuse the company of poor performance. A parliamentary report in March 2014 recommended that the government cancels Umeme’s concession.