The government has started enforcing the Tier 4 Microfinance and Money Lenders Act of 2016, a revised regulatory framework for microcredit providers, non-deposit taking institutions and saving groups.

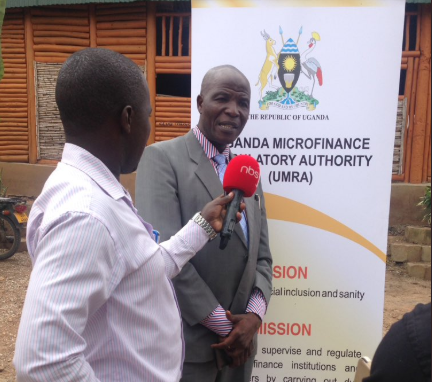

The new law establishes stringent conditions for persons trading as money lenders in Uganda, who are now required to register as corporate entities before transacting business. The law also empowers the Ministry of Finance to put in place a semi-autonomous supervisory body; the Uganda Microfinance Regulatory Authority, which is now charged with licensing and supervising money lenders.

The move comes at the backdrop of complaints against money lenders who are reportedly fleecing people through exorbitant interest rates on microloans.

State Minister for Micro-finance Haruna Kyeyune Kasolo says that the government is now putting in place safeguards for Ugandans seeking financial services from money lenders.

Kasolo adds that the ministry will soon begin blacklisting all unlicensed money lenders that are still operating in a rudimentary way.

Elly Avu Biliku, the Executive Director of the Micro-finance Regulatory Authority says they are currently reaching out to all money lenders to ensure that they comply with the law and help to generate a database of all sector players.